Most of use would like to pay the lowest price for an item or failing that, have the ability to split the payment into monthly instalments. The latter is called a Buy Now Pay Later BNPL) mode of payment. However, you can get caught into a cycle of buying too many items using BNPL and without a way of tracking the expenses, your monthly payments can easily total to an amount that exceeds your planned monthly expenditure or budget.

In addition to BNPL purchases, you also have fixed instalments like housing loans, car loans, rental, tuition fees and others that need to be taken into account as well. For expenses that are not fixed, you could create budgets to track them as well.

CARAT+ Defer is a web application that tracks all your fixed expenses and budget amounts. This gives you a heads-up on all possible expenses so that you have the ability to manage them efficiently to ensure that they do not exceed a fixed total budget for all of them.

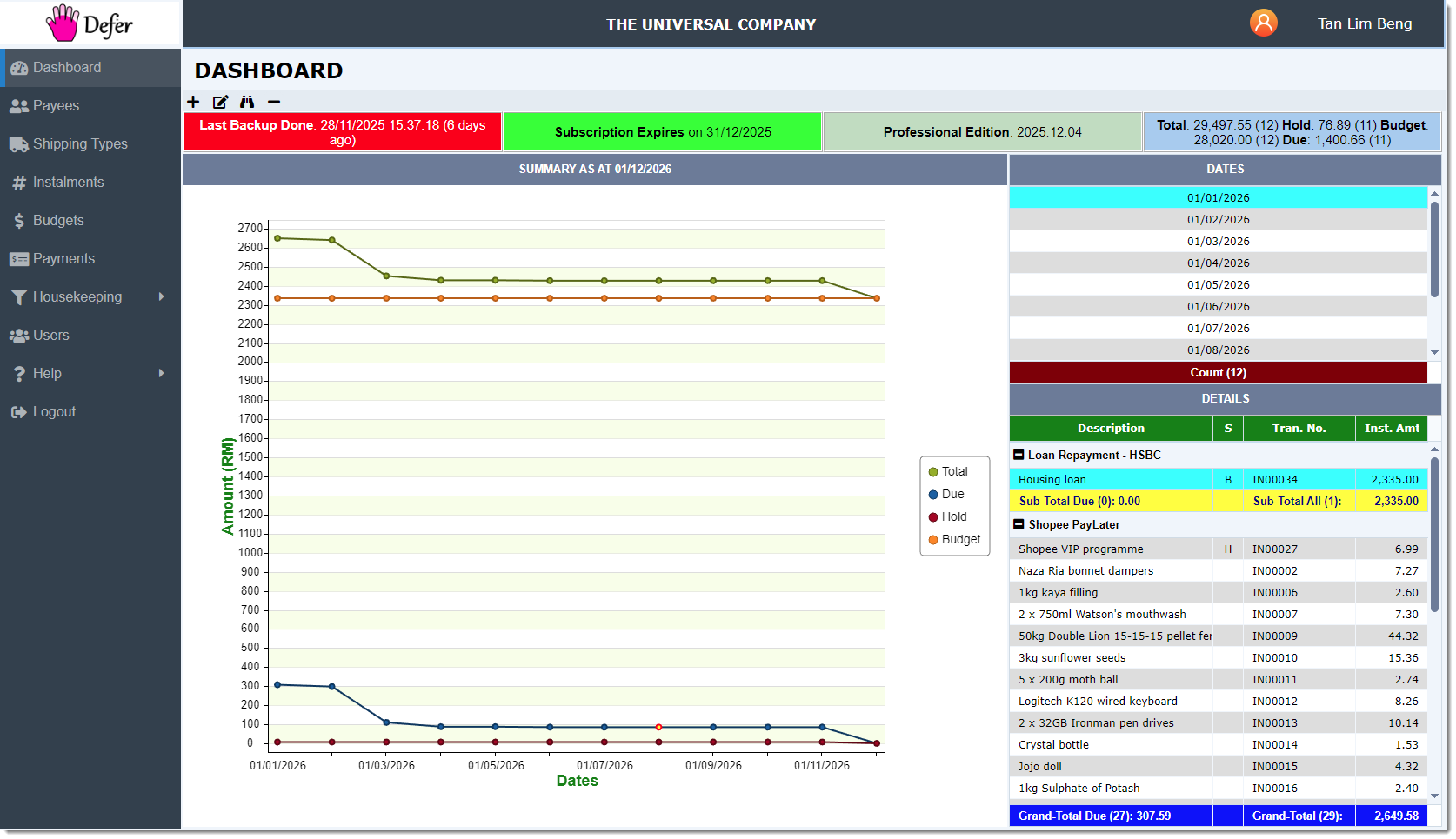

The following screenshot shows how CARAT+ Defer looks like.

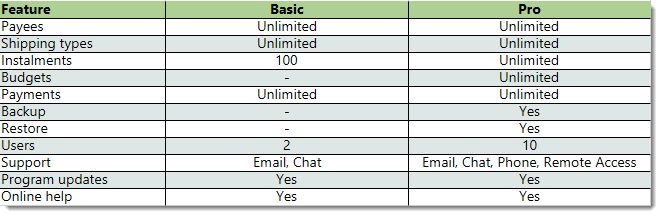

CARAT+ Defer is available in 2 editions. They Basic and Pro.

A table for the different editions is shown below:-

Evaluation

An evaluation for CARAT+ Defer is available on request. Please contact us if you are interested.